The COVID-19 pandemic has resulted in lockdowns and a severe disruption of economic activity across the world. On April 14, 2020, the IMF projected that the world economy is expected to contract by 3% in 2020, experiencing its worst recession since the Great Depression[i]. It has also cautioned that while provisioning of broad-based fiscal stimulus can avert an even deeper downturn, “it is most likely to be effective once the outbreak fades”[ii]. The current global economic crisis is qualitatively different from the 2008 financial crisis, as it is the consequence of a non-economic variable, the COVID-19 pandemic.

The lesson from the 2008 economic crisis was that large stimulus packages tend to work if they are implemented with precision and timely interventions.[iii] Today, in order to beat the coming recession, most countries have turned to Keynes’ prescription of infusing purchasing power among people and boosting employment through monetary and fiscal policies. Almost all major economies have resorted to stimulus packages to address the economic distress caused by the pandemic. In the last week of March, Germany announced a stimulus package of about $ 810 billion[iv] and the United States announced the largest ever stimulus package in its history, amounting to almost $ 2 trillion.[v] On April 6, 2020 Japan’s Prime Minister Shinzo Abe announced a big-bang stimulus package amounting to 108 trillion yen ($992 billion), equivalent to 20 percent of the country’s GDP[vi] (see Annexure).

For a few weeks, despite the looming threat of the pandemic, the Abe administration was reluctant to impose a State of Emergency. Such reticence stemmed from painful historical memories of an excessively powerful State prior to the Second World War.[vii] The fact that a monetary/fiscal stimulus package was announced simultaneously with the Declaration of a partial State of Emergency in some prefectures indicates that considerable preparation went into the whole exercise. It suggests that the Japanese government was keen on addressing the concerns of families and small businesses on the economic challenges that may arise due to the emergency measures aimed at containing the spread of the pandemic. PM Shinzo Abe did not impose complete lockdown; instead, he called on the people to reduce human-to-human interactions by 70 to 80 percent. PM Abe noted that Japan is confronted with the “greatest crisis of the post-war period” and his government would attempt to overcome this “together with the people by mobilizing all other conceivable policy instruments.”[viii]

The stimulus package has been welcomed by the public, as it will provide direct cash payments targeting various vulnerable sections. Households in which the head of the family’s income fell by at least half (from February to June) can submit necessary documentation on lost income to the local municipal governments in order to receive the direct cash transfer.[ix] Interestingly, private financial institutions will also provide five-year interest free loans for small business.[x] The package is to be implemented in two phases viz., (i) emergency measures to combat the pandemic such as increasing the stockpile of Avigan medicine as well as refurbishing Olympic stadiums to meet hospitalization needs and support families; and (ii) long-term economic measures, once the virus is contained, to ensure a “V-shaped” economic recovery such as “discount vouchers to revive tourism, transport, food services and event business sectors.”[xi]

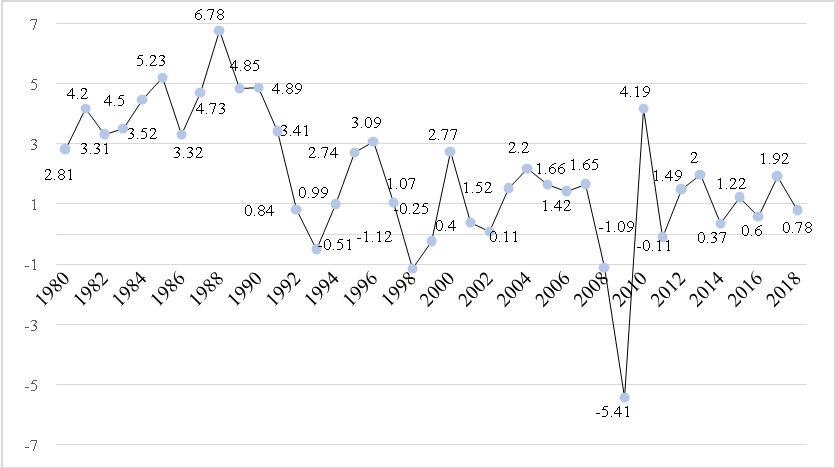

Graph - GDP Growth (Annual %) of Japan

Data Source: World Bank

Stimulus and Abe’s Three Arrows

For Japan, the current economic stimulus which was induced by a pandemic, has come in the midst of structural reforms that Prime Minister Shinzo Abe initiated several years ago. When Prime Minister Abe came to power in 2012, the Japanese economy was experiencing a deflationary economic crisis. To address this challenge, Abe introduced his “three-arrows” approach to reviving the economy – flexible fiscal policy, aggressive monetary policy and structural reform – which has come to be known as “Abenomics”[xii] The fiscal policy targeted the development of critical infrastructure; the monetary policy’s objective was to enhance liquidity in the economy; and structural reform sought to increase Japan’s competitiveness by various measures, such as cutting business regulations and increasing workforce diversity.[xiii] Abenomics has resulted in significant government spending to ensure that the economy achieves higher levels of growth[xiv] and has yielded some positive outcomes. In 2018, government data indicated that economic growth between 2012 and 2017 constituted the second most prolonged growth streak since the Second World War.[xv] Compared to 2012, the unemployment rate went down by about 2.4 percent, corporate pre-tax profit reached 42.1 JPY tn ($385 bn) and the number of women in the workforce increased.[xvi]

An important challenge confronting Abenomics was the need to address deficits. Instead of cutting government spending, Abe’s government sought to address this need through an increase in taxes. In 2014, the Abe government increased the consumption tax to 8% and the economy shrank by 7.3%.[xvii] In October 2019, the consumption tax was further increased to 10%[xviii]. Abe justified these tax increases as necessary for “all-generation” social welfare policies, such as the need to meet the requirements of an ageing society as well as contributing towards free education for young children.[xix] Learning from past experience, important household items such as groceries, takeout meals, and daily newspapers were exempted and incentives were provided for the purchase of cars and houses.[xx] However, the government’s assumption that the negative impact of increased taxation on the economy could be abated through these incentives did not yield the anticipated results. Further, a global downturn and a powerful typhoon altered the economic calculus.[xxi] As a consequence, the economy shrank by 6.3% in the last quarter of 2019.[xxii]

While many in Japan were agitated with the impact of the increased consumption tax on immediate economic growth, the International Monetary Fund (IMF) observed that the “consumption tax rate would need to increase gradually to 15 percent by 2030 and to 20 percent by 2050” in order to meet the costs of an ageing society.[xxiii] All this implies that the Japanese government needs to increase spending, plan for an ageing population, keep the interest rates low to provide enhanced liquidity to the economy and simultaneously ensure that the deficits and debt do not overwhelm the economic system.

Thus, Abe’s current economic stimulus comes amidst a challenging economic environment and an important casualty has been the need to address the debt burden. Currently, government debt as a share of Japan’s GDP is around 237.6%, which is high compared to other industrialised countries, such as the US (108%) and Germany (55.7%).[xxiv] Instead of reducing debt, the Japanese government is scaling up its debt burden to pay for the fresh stimulus. According to various reports, the government plans to raise more debt by an increase in bond sales to almost 147 trillion yen ($1.35 trillion), or 30% of the size of Japan's economy, to pay for the stimulus.[xxv]” There are thus concerns that the economic stimulus will further increase the debt burden, making it difficult to meet the needs of a society with an ageing population. On the other hand, much of the debt is predominantly funded by domestic capital with low interest rates.[xxvi] However, Japan needs to achieve higher growth rates and requires a favourable global economy in order to reduce deficits and avoid recourse to foreign capital.[xxvii]

International Response to Stimulus

The Abe government’s stimulus package has received considerable domestic approbation. However, at the international level, countries such as Germany and South Korea have expressed apprehension, stating that Tokyo’s stimulus will weaken the Japanese currency considerably, thereby making its exports globally more competitive.[xxviii] Further, the Japanese government’s reported decision to allocate “220 billion yen ($2 billion) for companies shifting production back to Japan and 23.5 billion yen for those seeking to move production to other countries” has drawn considerable attention. While this provision does not specifically mention China, some analysts are interpreting the additional support to promote domestic supply chains as a move targeting Beijing. Compared to the scale of Japanese investments in China, the allocation of $2 billion amounts to a meagre sum.[xxix] Nonetheless, this policy measure sends a clear message to Japanese companies on the need to diversify overseas investment patterns. If other countries also adopt similar measures, we may gradually see a significant shift in global supply chains.

Conclusion

There has been some criticism that Japanese government delayed closing doors on Chinese tourists because of a much anticipated summit meeting between Shinzo Abe and Xi Jinping.[xxx] On the other hand, it is being argued that the delay in declaring the state of emergency in worst affected areas has stemmed from confidence that Japan may not see a spike in infections due to inherent societal advantages such as “a culture where handshakes and hugs are less common.[xxxi]” However, these partial measures have proved inadequate and Prime Minister Abe has finally had to declare nation-wide state of emergency on April 16, 2020 following considerable criticism that attempts to keep much of the economy running have come at the expense of public health, with steadily increasing coronavirus infections. Abe has also announced that fresh legislation is planned to provide Yen 100,000 ($ 930) in cash to every person in Japan to counter the economic impact of the emergency, which go beyond the earlier more conditional plans for payouts to affected households alone.

Japan’s recent experience suggests the need for decisive political leadership at multiple levels with well-coordinated interventions to address public anxiety about economic hardships during a pandemic. This was evident in the announcement of the stimulus package and now its likely expansion. Further, the economic stimulus packages implemented by various developed countries indicate that the State has regained a preeminent position in rearranging and reviving economic activity. Today, even the most ardent supporters of the free market economy recognise the important role of the state apparatus in addressing the onset of an unprecedented economic recession. Compared with the 2008 experience, the concept of direct-cash-transfers has acquired greater salience in the stimulus measures for two reasons: first, with the spread of social media, small businesses and lower-middle classes have become powerful constituencies demanding special attention in times of economic crisis; second, the improvement in digital technologies has provided governments with new tools to reach beneficiaries directly with greater efficiency. We will never know if Keynes would have approved of governments putting cash in the hands of people to increase purchasing power. However, the efficacy of direct-cash-transfers during a recession will become evident very soon. Eventually, the comparative success or failure of stimulus packages will also determine the balance-of-power dynamics in the international order.

The lesson from the 2008 economic crisis was that large stimulus packages tend to work if they are implemented with precision and timely interventions.[iii] Today, in order to beat the coming recession, most countries have turned to Keynes’ prescription of infusing purchasing power among people and boosting employment through monetary and fiscal policies. Almost all major economies have resorted to stimulus packages to address the economic distress caused by the pandemic. In the last week of March, Germany announced a stimulus package of about $ 810 billion[iv] and the United States announced the largest ever stimulus package in its history, amounting to almost $ 2 trillion.[v] On April 6, 2020 Japan’s Prime Minister Shinzo Abe announced a big-bang stimulus package amounting to 108 trillion yen ($992 billion), equivalent to 20 percent of the country’s GDP[vi] (see Annexure).

For a few weeks, despite the looming threat of the pandemic, the Abe administration was reluctant to impose a State of Emergency. Such reticence stemmed from painful historical memories of an excessively powerful State prior to the Second World War.[vii] The fact that a monetary/fiscal stimulus package was announced simultaneously with the Declaration of a partial State of Emergency in some prefectures indicates that considerable preparation went into the whole exercise. It suggests that the Japanese government was keen on addressing the concerns of families and small businesses on the economic challenges that may arise due to the emergency measures aimed at containing the spread of the pandemic. PM Shinzo Abe did not impose complete lockdown; instead, he called on the people to reduce human-to-human interactions by 70 to 80 percent. PM Abe noted that Japan is confronted with the “greatest crisis of the post-war period” and his government would attempt to overcome this “together with the people by mobilizing all other conceivable policy instruments.”[viii]

The stimulus package has been welcomed by the public, as it will provide direct cash payments targeting various vulnerable sections. Households in which the head of the family’s income fell by at least half (from February to June) can submit necessary documentation on lost income to the local municipal governments in order to receive the direct cash transfer.[ix] Interestingly, private financial institutions will also provide five-year interest free loans for small business.[x] The package is to be implemented in two phases viz., (i) emergency measures to combat the pandemic such as increasing the stockpile of Avigan medicine as well as refurbishing Olympic stadiums to meet hospitalization needs and support families; and (ii) long-term economic measures, once the virus is contained, to ensure a “V-shaped” economic recovery such as “discount vouchers to revive tourism, transport, food services and event business sectors.”[xi]

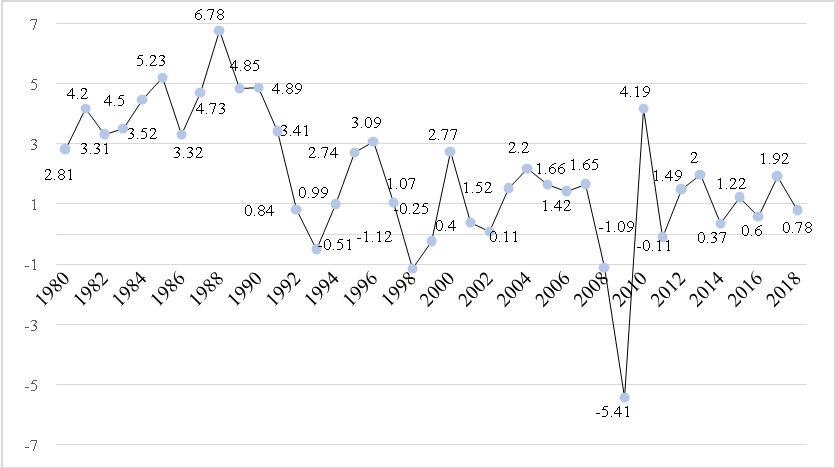

Graph - GDP Growth (Annual %) of Japan

Data Source: World Bank

Stimulus and Abe’s Three Arrows

For Japan, the current economic stimulus which was induced by a pandemic, has come in the midst of structural reforms that Prime Minister Shinzo Abe initiated several years ago. When Prime Minister Abe came to power in 2012, the Japanese economy was experiencing a deflationary economic crisis. To address this challenge, Abe introduced his “three-arrows” approach to reviving the economy – flexible fiscal policy, aggressive monetary policy and structural reform – which has come to be known as “Abenomics”[xii] The fiscal policy targeted the development of critical infrastructure; the monetary policy’s objective was to enhance liquidity in the economy; and structural reform sought to increase Japan’s competitiveness by various measures, such as cutting business regulations and increasing workforce diversity.[xiii] Abenomics has resulted in significant government spending to ensure that the economy achieves higher levels of growth[xiv] and has yielded some positive outcomes. In 2018, government data indicated that economic growth between 2012 and 2017 constituted the second most prolonged growth streak since the Second World War.[xv] Compared to 2012, the unemployment rate went down by about 2.4 percent, corporate pre-tax profit reached 42.1 JPY tn ($385 bn) and the number of women in the workforce increased.[xvi]

An important challenge confronting Abenomics was the need to address deficits. Instead of cutting government spending, Abe’s government sought to address this need through an increase in taxes. In 2014, the Abe government increased the consumption tax to 8% and the economy shrank by 7.3%.[xvii] In October 2019, the consumption tax was further increased to 10%[xviii]. Abe justified these tax increases as necessary for “all-generation” social welfare policies, such as the need to meet the requirements of an ageing society as well as contributing towards free education for young children.[xix] Learning from past experience, important household items such as groceries, takeout meals, and daily newspapers were exempted and incentives were provided for the purchase of cars and houses.[xx] However, the government’s assumption that the negative impact of increased taxation on the economy could be abated through these incentives did not yield the anticipated results. Further, a global downturn and a powerful typhoon altered the economic calculus.[xxi] As a consequence, the economy shrank by 6.3% in the last quarter of 2019.[xxii]

While many in Japan were agitated with the impact of the increased consumption tax on immediate economic growth, the International Monetary Fund (IMF) observed that the “consumption tax rate would need to increase gradually to 15 percent by 2030 and to 20 percent by 2050” in order to meet the costs of an ageing society.[xxiii] All this implies that the Japanese government needs to increase spending, plan for an ageing population, keep the interest rates low to provide enhanced liquidity to the economy and simultaneously ensure that the deficits and debt do not overwhelm the economic system.

Thus, Abe’s current economic stimulus comes amidst a challenging economic environment and an important casualty has been the need to address the debt burden. Currently, government debt as a share of Japan’s GDP is around 237.6%, which is high compared to other industrialised countries, such as the US (108%) and Germany (55.7%).[xxiv] Instead of reducing debt, the Japanese government is scaling up its debt burden to pay for the fresh stimulus. According to various reports, the government plans to raise more debt by an increase in bond sales to almost 147 trillion yen ($1.35 trillion), or 30% of the size of Japan's economy, to pay for the stimulus.[xxv]” There are thus concerns that the economic stimulus will further increase the debt burden, making it difficult to meet the needs of a society with an ageing population. On the other hand, much of the debt is predominantly funded by domestic capital with low interest rates.[xxvi] However, Japan needs to achieve higher growth rates and requires a favourable global economy in order to reduce deficits and avoid recourse to foreign capital.[xxvii]

International Response to Stimulus

The Abe government’s stimulus package has received considerable domestic approbation. However, at the international level, countries such as Germany and South Korea have expressed apprehension, stating that Tokyo’s stimulus will weaken the Japanese currency considerably, thereby making its exports globally more competitive.[xxviii] Further, the Japanese government’s reported decision to allocate “220 billion yen ($2 billion) for companies shifting production back to Japan and 23.5 billion yen for those seeking to move production to other countries” has drawn considerable attention. While this provision does not specifically mention China, some analysts are interpreting the additional support to promote domestic supply chains as a move targeting Beijing. Compared to the scale of Japanese investments in China, the allocation of $2 billion amounts to a meagre sum.[xxix] Nonetheless, this policy measure sends a clear message to Japanese companies on the need to diversify overseas investment patterns. If other countries also adopt similar measures, we may gradually see a significant shift in global supply chains.

Conclusion

There has been some criticism that Japanese government delayed closing doors on Chinese tourists because of a much anticipated summit meeting between Shinzo Abe and Xi Jinping.[xxx] On the other hand, it is being argued that the delay in declaring the state of emergency in worst affected areas has stemmed from confidence that Japan may not see a spike in infections due to inherent societal advantages such as “a culture where handshakes and hugs are less common.[xxxi]” However, these partial measures have proved inadequate and Prime Minister Abe has finally had to declare nation-wide state of emergency on April 16, 2020 following considerable criticism that attempts to keep much of the economy running have come at the expense of public health, with steadily increasing coronavirus infections. Abe has also announced that fresh legislation is planned to provide Yen 100,000 ($ 930) in cash to every person in Japan to counter the economic impact of the emergency, which go beyond the earlier more conditional plans for payouts to affected households alone.

Japan’s recent experience suggests the need for decisive political leadership at multiple levels with well-coordinated interventions to address public anxiety about economic hardships during a pandemic. This was evident in the announcement of the stimulus package and now its likely expansion. Further, the economic stimulus packages implemented by various developed countries indicate that the State has regained a preeminent position in rearranging and reviving economic activity. Today, even the most ardent supporters of the free market economy recognise the important role of the state apparatus in addressing the onset of an unprecedented economic recession. Compared with the 2008 experience, the concept of direct-cash-transfers has acquired greater salience in the stimulus measures for two reasons: first, with the spread of social media, small businesses and lower-middle classes have become powerful constituencies demanding special attention in times of economic crisis; second, the improvement in digital technologies has provided governments with new tools to reach beneficiaries directly with greater efficiency. We will never know if Keynes would have approved of governments putting cash in the hands of people to increase purchasing power. However, the efficacy of direct-cash-transfers during a recession will become evident very soon. Eventually, the comparative success or failure of stimulus packages will also determine the balance-of-power dynamics in the international order.

***

Annexure

| Overview of the Supplementary Budget for FY2020%uFF08April 7, 2020%uFF09 | ||

| I | Expenses related to Emergency Economic Package against the COVID-19 | ¥16,705.8bn |

| |

1. Develop preventive measures against the spread of infection and medical treatment structures, as well as pharmaceuticals | ¥1,809.7bn |

|

|

|

| 2. Protect employment and sustain business continuity | 10,630.8bn | |

| |

*Budgeted in the General Account, to support employees who work less than 20 hours per week. ¥764.0bn is accounted in the Special Account for Employment Insurance for employees who work 20 hours per week and more.

|

|

| 3. Recover economic activities through public-private efforts, as the next phase | ¥1,848.2bn | |

| |

|

|

| 4. Develop a resilient economic structure | ¥917.2bn | |

| |

|

|

| 5. Prepare for the future | ¥1,500.0bn | |

|

||

| %u2161 | Transfer to the special account for national debt consolidation funds | ¥99.9bn |

| Additional spending of the supplementary budget | ¥16,805.7bn | |

Source: “Overview of the Supplementary Budget for FY2020 April 7, 2020),” Ministry of Finance, Government of Japan, available at https://www.mof.go.jp/english/budget/budget/fy2020/02.pdf

End Notes:

[i] International Monetary Fund (2020), World Economic Outlook, April 2020: Chapter 1, World Economic Outlook Reports. Retrieved from: https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

[ii] ibid

[iii] International Institute for Labour Studies (2011), A Review of Global Fiscal Stimulus. Joint Discussion Paper Series No. 5. Pp 5. ; also seeIzvorski, I (2018). 10 Years Later: 4 Lessons from the Global Financial Crisis. Brookings. Retrieved from:https://www.brookings.edu/blog/future-development/2018/06/25/10-years-later-4-fiscal-policy-lessons-from-the-global-financial-crisis/

[iv] Reuters (2020),Factbox: Germany's anti-coronavirus stimulus package. Retrieved from: https://www.reuters.com/article/us-health-coronavirus-germany-measures-f/factbox-germanys-anti-coronavirus-stimulus-package-idUSKBN21C26Y

[vi]Prime Minister of Japan and His Cabinet (2020), [COVID-19] Press Conference by the Prime Minister Regarding the Declaration of a State of Emergency. Retrieved From: https://japan.kantei.go.jp/98_abe/statement/202004/_00001.html

[vii] Pallavi Aiyar, "Lockdown with Japanese Characteristics," The Hindu, April 11, 2020, available at https://www.thehindu.com/news/international/lockdown-with-japanese-characteristics/article31318942.ece ; also see Lawrence Repeta, “The Coronavirus and Japan’s Constitution,” Japan Times, April 14, 2020, available at https://www.japantimes.co.jp/opinion/2020/04/14/commentary/japan-commentary/coronavirus-japans-constitution/#.XpYfV0AzbIV

[viii]ibid

[ix]Miki, R (2020), Japan’s $1tn stimulus offers $18,000 to mom and pop businesses, Japan Times. Retrieved from: https://asia.nikkei.com/Economy/Japan-s-1tn-stimulus-offers-18-000-to-mom-and-pop-businesses

[x]Sposato, W (2020), Japan Is Testing the Limits of Pandemic Economics, Foreign Policy. Retrieved from: https://foreignpolicy.com/2020/04/10/coronavirus-stimulus-japan-is-testing-the-limits-of-pandemic-economics/

[xi]Prime Minister of Japan and His Cabinet (2020),[COVID-19] Government Responses on the Coronavirus Disease 2019. Retrieved From: http://japan.kantei.go.jp/ongoingtopics/_00013.html

[xii]McBride, J & Xu, B (2018), Abenomics and the Japanese Economy, Council on Foreign Relations. Retrieved from:https://www.cfr.org/backgrounder/abenomics-and-japanese-economy

[xiii]McLannahan, B. Bank of Japan Unveils Aggressive Easing, Financial Times. Retrieved from: https://www.ft.com/content/81fbc13c-9cd6-11e2-9a4b-00144feabdc0#axzz3 also see McBride,J & Xu, B (2018), Abenomics and the Japanese Economy.Council on Foreign Relations. Retrieved from: https://www.cfr.org/backgrounder/abenomics-and-japanese-economy

[xiv]Uesugi, M (2020), Has Abenomics Run out of Steam?, Nikkei Asian Review. Retrieved from: https://asia.nikkei.com/Spotlight/Comment/Has-Abenomics-run-out-of-steam

[xv]Kaneko, K (2018).Japan confirms economy in second best stretch of post-war growth.Reuters. Retrieved from: https://www.reuters.com/article/us-japan-economy-expansion/japan-confirms-economy-in-second-best-stretch-of-post-war-growth-idUSKBN1OC0PN

[xvii]Nohara, Y (2019), Japan Tries to Learn Lessons from 2014 Sales Tax Blow Charts, Bloomberg. Retrieved from: https://www.bloomberg.com/news/articles/2019-09-10/japan-tries-to-learn-lessons-from-2014-sales-tax-blow-charts

[xviii] Nikkei Asian Review (2020), Japan’s Economy is Contracting, 90% of Economists Say in Survey. Retrieved from: https://asia.nikkei.com/Economy/Japan-s-economy-is-contracting-90-of-economists-say-in-survey

[xix]Mainichi Japan (2018), PM Abe confirms consumption tax hike in 2019, measures to stimulate economy. Retrieved from:https://mainichi.jp/english/articles/20181015/p2a/00m/0na/020000c

[xx] Dooley, B, Ueno, H &Yamamitsu, E (2019), Japan Raises Taxes on Its Spenders Despite Growth Worries, New York Times. Retrieved from: https://www.nytimes.com/2019/09/30/business/japan-abe-consumption-tax.html

[xxi]Takeo, Y & Ito, S (2020), History Repeats as Consumption Tax Hike Pushes Japan Toward Recession, Japan Times. Retrieved from: https://www.japantimes.co.jp/news/2020/02/25/business/economy-business/sales-tax-recession/#.Xo97xZMzbjA

[xxii]The Economist (2020), Japan’s GDP shrinks dramatically after a tax rise and a typhoon. Retrieved from: https://www.economist.com/asia/2020/02/20/japans-gdp-shrinks-dramatically-after-a-tax-rise-and-a-typhoon

[xxiii]International Monetary Fund (2019), Japan: Staff Concluding Statement of the 2019 Article IV Mission, Mission Concluding Statement. Retrieved from: https://www.imf.org/en/News/Articles/2019/11/24/mcs-japan-staff-concluding-statement-of-the-2019-article-iv-mission

[xxiv]International Monetary Fund, General Government Gross Data. Retrieved from: https://www.imf.org/external/datamapper/GGXWDG_NGDP@WEO/OEMDC/ADVEC/WEOWORLD/JPN/USA/DEU

[xxv]France 24 (2020), Japan’s Nearly 1 trillion Coronavirus Stimulus Upends PM Abe’s Debt Fight. Retrieved from: https://www.france24.com/en/20200410-japan-s-nearly-1-trillion-coronavirus-stimulus-upends-pm-abe-s-debt-fight

[xxvi]Shirai, S (2019), Japan's growing debt divergence, Japan Times. Retrieved from: https://www.japantimes.co.jp/opinion/2019/05/14/commentary/japan-commentary/japans-growing-debt-divergence/#.XpMpGUBLjIU

[xxvii]ibid

[xxviii]Kihara, L (2013), Japan PM Shrugs Off Global Criticism Over Latest Stimulus Steps, Reuters. Retrieved from: https://www.reuters.com/article/us-japan-economy-abe/japan-pm-shrugs-off-global-criticism-over-latest-stimulus-steps-idUSBRE90T06420130130

[xxix] “Overview of the Supplementary Budget for FY2020 April 7, 2020),” Ministry of Finance, Government of Japan, available at https://www.mof.go.jp/english/budget/budget/fy2020/02.pdf

[xxx] Mike Green, "How is Japan Handling the Covid-19 Pandemic?", Center for Strategic & International Studies, available at https://www.youtube.com/watch?v=XN3R_BGihZE

[xxxi] Gearoid Reidy, "Japan was Expecting a Coronavirus Explosion. Where is it?", Japan Times, March 20, 2020, available at https://www.japantimes.co.jp/news/2020/03/20/national/coronavirus-explosion-expected-japan/#.Xpgs9UAzbIV